The great transition of the mortgage market, from having a heavy share of fixed-rate loans to now being dominated by variable-rate loans, has gathered pace, according to Reserve Bank data.

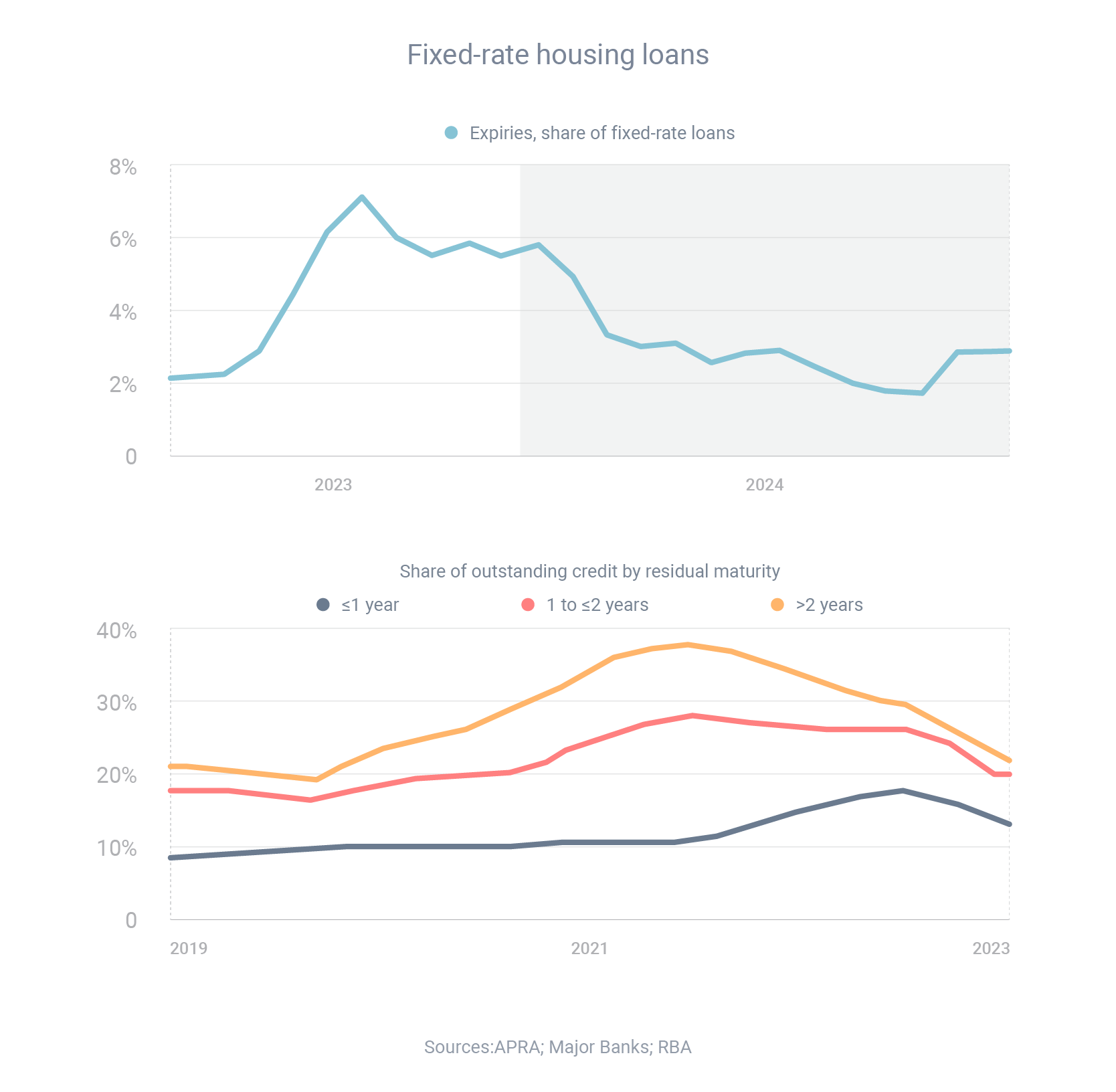

During 2020 and 2021, when interest rates fell to record-low levels, enormous numbers of borrowers took out two-year and three-year fixed loans at very low interest rates. Many of those loans then expired as rates started rising, meaning that many borrowers have been reverting from ultra-low fixed rates to significantly higher variable rates.

“The fixed-rate share of total outstanding housing credit declined to 22% in September, well below its peak of just under 40% at the start of 2022,” the Reserve Bank reported in its recent Statement of Monetary Policy.

Over recent months, the number of fixed loans that have expired have outweighed the number of new fixed loans that have been initiated, by a ratio of more than five to one.

“Most of the remaining fixed-rate loans are expected to expire by the end of 2024,” according to the Reserve Bank.

There are many different types of finance we can help with

View our Services on our website or Contact Us to discuss your needs